Many people like to use an envelope system to control the spending in these areas more closely. The daily living categories such as groceries, fun and fuel tend to be highly variable. Some of these could be envelope categories, but in general, these are for bills that you can set on AutoPay. These are your utilities, subscriptions, and other recurring bills that may be variable, but are pretty much consistent and predictable. Whether you list your mortgage as a big bill or a debt is up to you. If you have a lot of different debts, you may need to lump some of them into categories such as "credit cards" and "students loans." If you are using a debt snowball, only include the MINIMUM monthly payments in this section! The debt snowball is included in the Savings section.

The point is that you have a place called BIG BILLS to remind you to budget for the big important stuff, the stuff that if you don't plan for, could break you. Whether you call some of these categories "sinking funds" or "short-term savings" doesn't matter in this worksheet. Some people like to track the savings for big bills in separate accounts, sometimes even a separate sub-accounts. You can divide in Excel using a formula such as =1500/12. For a monthly budget, divide the total average yearly cost of a large bill by 12. Things like medical bills, home repairs, and car repairs can be budgeted ahead of time so that you have the money when you need it. Nobody makes it through life without unexpected big bills. This would also be a place to pull out priority savings to apply the "pay yourself first" principle. If you pay a tithe (the "pay God first" principle), then you can multiply by a percent in excel using a formula such as =10%*B9 where B9 is the Total Income. This category is for making adjustments to your gross income, such as listing the tax withholdings and other deductions from your paycheck. They are designed to help you apply the 'Pay God First' principle, the 'Pay Yourself First' principal, the 'Debt Snowball' and 'Savings Snowball' techniques, the 'Sinking Funds' idea, and the 'Envelope Budget' system. The categories in this worksheet have a very purposeful structure. Step 2: Enter Your Budget (Savings and Expenses) If your income varies a lot, you can base your budget on what you expect the minimum for the month will be. If you get paid weekly, you can base your budget on 4 weeks. If you actually get paid biweekly, you may want to base your budget on just two weeks of pay, then use your extra paycheck twice per year to do something special.

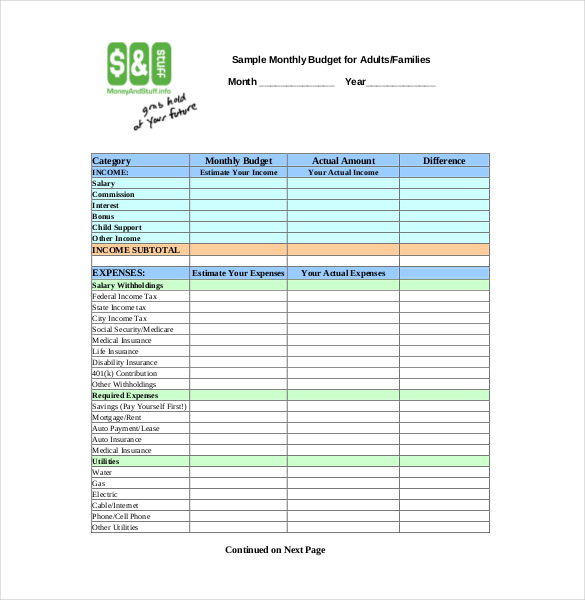

If you are creating a monthly budget, list all sources of income for the month.

0 kommentar(er)

0 kommentar(er)